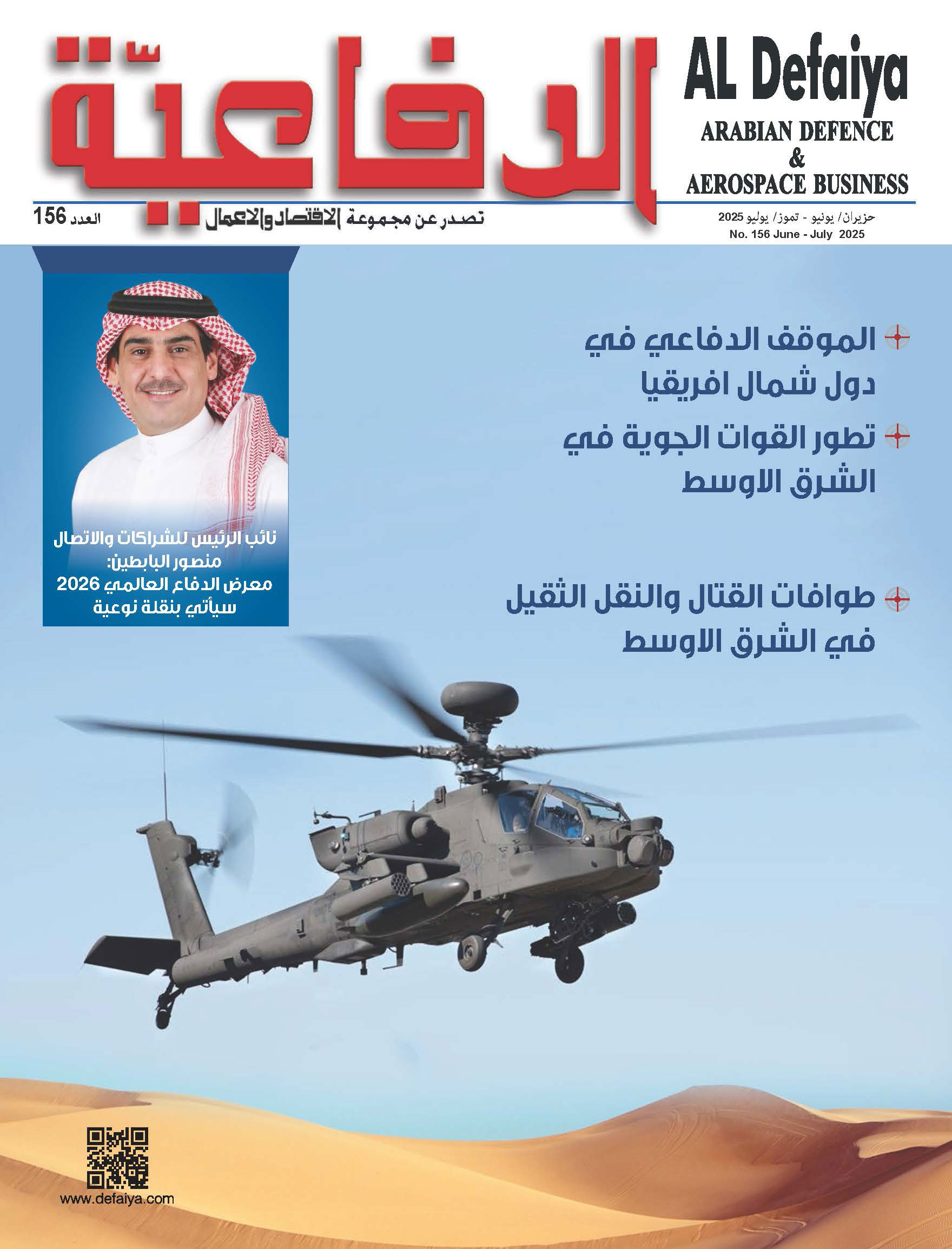

The region's airlines are securing funds as they take delivery of what Boeing has forecast to be a need for 2,610 aircraft by 2033, valued at $550 billion.

Dubai's Emirates airline has signed a Dh1.1 billion ($299.5 million) financing deal with a group of banks for the purchase of two Boeing planes.

First Gulf Bank, the third-largest lender by assets in the UAE, led the club finance lease package on behalf of Emirates for the two 777-300ER aircraft, the bank said in a statement.

Separately, Dubai Islamic Bank and Air Arabia said they had signed a $230 million Islamic financing deal to cover the purchase of six new Airbus A320 aircraft in 2015 by the budget airline.

The Ijara-structured facility will pay for the delivery of a new aircraft every two months from January. The Sharjah-based low cost carrier had received 29 of the 44 A320s it ordered from Airbus in 2007, the joint statement said.

Ijara is a leasing arrangement commonly used to structure Islamic financing facilities.

The deals follow Qatar Airways closing a sale and operating leaseback transaction with Standard Chartered for three 777-300ER and five 787-8 aircraft. It was the first sale and leaseback transaction entered into by the Qatari flag carrier, according to local press reports on Tuesday.

Emirates and Qatar are among the fastest-growing airlines in the world. In July, Emirates finalised a $56 billion to buy 150 777X jets, while Qatar ordered 50 of the aircraft.

Source: Reuters