The Saudi sovereign-wealth fund bought big stakes in Boeing and other U.S. tech, bank and travel stocks during Q1 as the Kingdom continues to diversify its investments outside energy by looking for bargains amid the coronavirus pandemic, Investor’s Business Daily reported.

The Public Investment Fund disclosed a $714 million stake in Boeing stock in a regulatory filing last Friday. The aerospace giant has seen its orders tumble as air travel falls amid COVID-19 related travel restrictions.

The massive investment in Boeing stock comes despite prospects for a prolonged slump in air travel, which industry leaders estimate won’t return to pre-pandemic levels for 3-5 years.

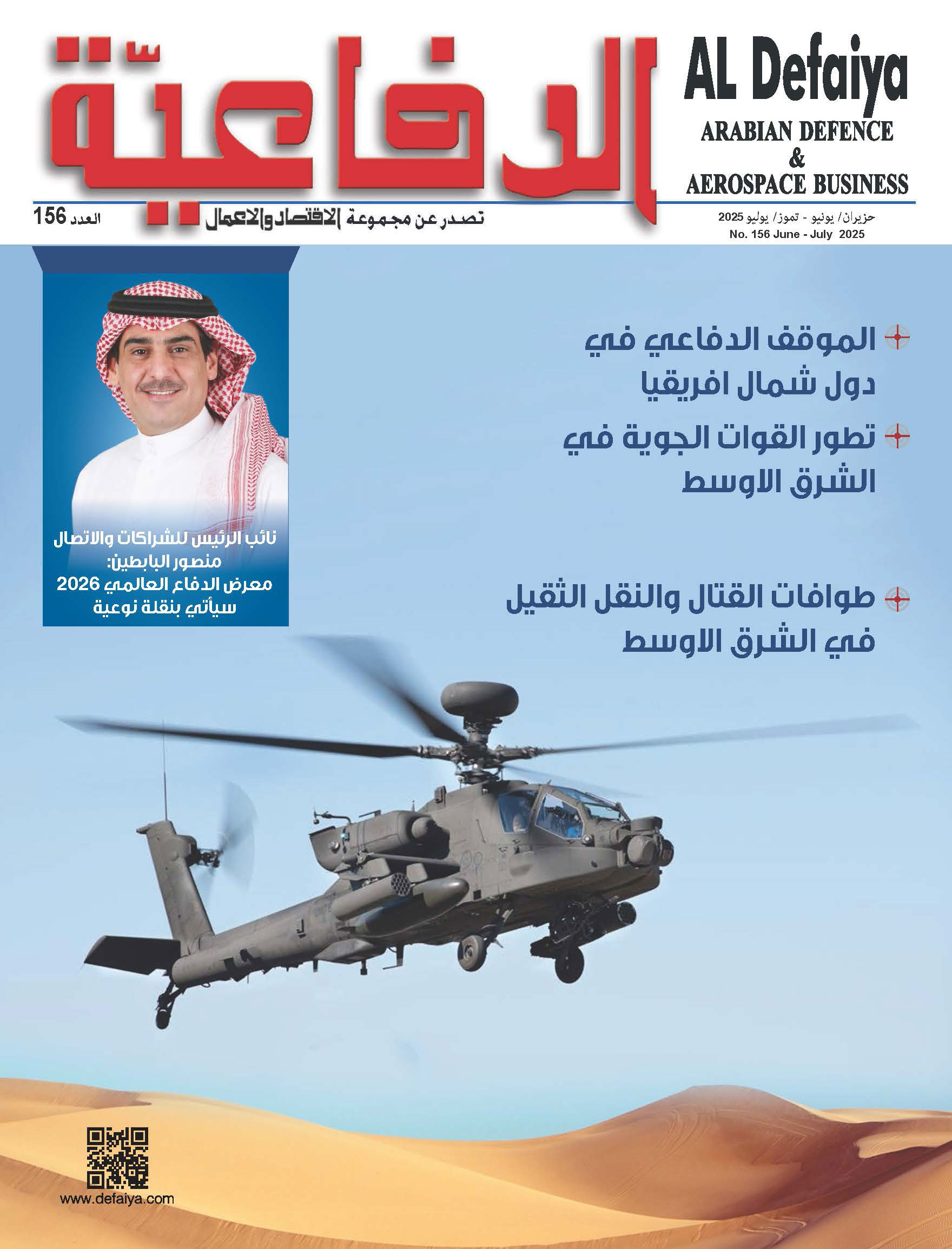

The U.S. aerospace giant’s 737 Max single-aisle jet has been grounded over a year following two deadly crashes, while customers are rushing to cancel and defer aircraft orders. But as orders on the commercial side fall, the U.S. government has continued to buy weapons from Boeing under foreign military sales contracts.

Last week, Boeing received a $2.6 billion dollar order from the U.S. Navy to build Harpoon and Standoff Land Attack Missile Expanded Response (SLAM ER) missiles. The SLAM ER contract is worth $1.97 billion and includes 650 of the extended range missiles for the Saudi government. The Harpoon contact is for $650 million and includes 400 of the anti-ship missiles for Saudi Arabia.

The Saudi wealth fund also bought a $522 million stake in Citigroup, $488 million in Bank of America, and $500 million in Disney, Facebook, Marriott and Cisco during the first quarter.

Last month, the fund disclosed stakes in cruise line operator Carnival and ticker provider and concert promoter Live Nation Entertainment.

The travel and entertainment sectors have taken a massive hit since the coronavirus pandemic began spreading in March. Cruise ships became hot spots where the virus ran rampant and concerts and sporting events were postponed or canceled. Disney closed its theme parks across the U.S. Europe and Asia.

The lack of travel has weighed on demand for Saudi Arabia’s oil. The Kingdom has seen a sharp drop in oil prices as travel is curtailed during COVID-19 lockdown and cut its production output to 7.5 million barrels per day in an effort to balance the oil markets.