Lockheed Martin Corporation, already the biggest US weapons maker and largest provider of IT services to the US government, wants to become a powerhouse in foreign markets such as the Middle East and India, said a top Executive.

Lockheed made about 17% of its $47 billion of revenue abroad in 2012, or $8 billion, and will “absolutely” exceed its current goal of 20%, Pat Dewar, Senior Vice President for Corporate Strategy and Business Development, told Reuters.

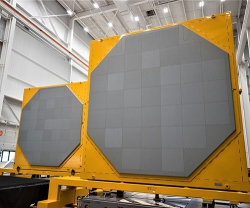

The maker of the F-35 fighter jet (photo) and Aegis missile systems still lags rivals Raytheon Company, with about 26% of sales from abroad, and Boeing's defense division, which says about 42% of its backlog is outside the US. Both rivals are targeting 30% foreign revenue.

“We're moving much more aggressively in the international domain,” Dewar said at last week’s Paris Air show, without giving a new target. “We're going global in a much bigger way.”

Lockheed and other big US arms manufacturers are looking to exports and foreign markets to provide continued growth as US military spending slows amid mounting fiscal pressures, and the end of the wars in Iraq and Afghanistan.

Lockheed is already working in 70 countries and has what it calls “home team capability” in Britain, Australia and Canada. Now it plans to pump up local operations in other areas such as the UAE, Saudi Arabia, Japan and India.

“We are going to move the corporation from being essentially overwhelmingly U.S. with international sales, to being a healthy local delivery system in those countries where the governmental relations are strong, and where industry relations are strong or can be strengthened,” Dewar said.

Lockheed hopes focusing more on local operations, rather than merely selling products or bringing in experts from US sites, will give it the edge over its competitors, Dewar said.

In February, Lockheed opened new headquarters in Riyadh, in Saudi Arabia, and signed an agreement with Saudi Arabian Airlines to pursue opportunities such as a new training organization for the aerospace sector.

Lockheed has already sold its Terminal High Altitude Area Defense (THAAD) missile defense system to the UAE, where it has a stake in a large aircraft maintenance and overhaul business.

Saudi Arabia is looking closely at the THAAD system and has been briefed by the Pentagon's Missile Defense Agency, he said.

In India, the company has a joint venture with Tata Advanced Systems for manufacturing airframe components for the C-130J, a large transport plane that Lockheed is selling to India.

“We think that's a base of operations and a base to expand from,” Dewar said.

Lockheed also has a large industrial partnership with Italy's Alenia, a unit of Finmeccanica, for final assembly of the F-35, and just signed a similar deal in Japan with Mitsubishi Heavy Industries.

In addition to weapons-related work, Lockheed sees growing opportunities for civilian projects and already runs the census or manages postal systems in Britain, Canada and Australia.

Dewar sees Lockheed's strength as being able to apply experience managing logistics for big weapons systems to government IT, as it has done in the U.S., where it has been the government's top information technology provider for 18 years.

Cyber security is drawing particular interest from other governments, particularly in the Middle East and Asia, Dewar said, although he declined to identify specific customers.

Lockheed is one of the big players in the U.S. cyber market, where it provides a range of services for the military and intelligence services. Escalating cyber attacks against global computer networks, including Saudi Arabia's national oil and gas company, are generating demand for similar services overseas.

Source: Reuters