One of the main factors driving the Omani defense budget is the arms race with countries such as Syria, Iraq, and Yemen, combined with a perceived threat from Iran. To be on par with its neighbors, Oman increased its military budget sharply over the last couple of years to value US$9.3 billion in 2013, registering a growth rate of 23.10% since 2009.

The sharp rise in the defense budget in 2012-2013 was made possible by increasing oil prices, which generated additional revenue for the government and was directed towards strengthening its defense and security. By 2018 the country’s defense and security expenditure is estimated to grow at a compound annual growth rate CAGR of 6.76% to reach US$13 billion by 2018, owing to the procurement of advanced military equipment and regional dynamics.

Various deals with the US to get hold of F-16 aircraft, air missile defense systems, and other arms imports have fuelled the growth of the capital budget allocation during 2012 and 2013. The country is expected to continue to buy advanced weapons in order to achieve its purpose of becoming a substantial military force in the region.

Oman is projected to allocate an average of 19.5% of its defense and security budget towards related capital expenditure by 2018.

Oman’s defense imports witnessed a decline in 2010 and 2011, but increased sharply in 2012 due to new procurement deals signed during 2011-2012. In the past, Oman has sourced the majority of its defense imports from companies based in the UK, such as BAE Systems.

However during 2009, France and the US dominated by fulfilling 61.3% and 31.4% of Oman’s arms imports. Aircraft accounted for more than 75% of Oman’s arms imports during this period. With missiles, armored vehicles, and air defense systems being other major categories procured from foreign suppliers.

Air defense capabilities such as fighter aircraft, surface to air missiles, and radars are expected to be an area of focus for the Omani Ministry of Defense (MoD) during 2018. The government is also expected to focus on protecting its oil maritime trade routes and strengthening its maritime borders with the procurement of patrol vessels and frigates. Additionally, these procurements can help improve security in the country’s international borders.

Oman allows foreign investment in its domestic defense industry but limits it to 49%, which has to be approved by the Ministry of Commerce and Industry. However, Oman does not disclose information about direct offset obligations but does give preference to companies offering indirect offsets ranging from supply of foods to investment in non-defense sectors in the country.

The Sultanate maintains strong relations with the UK and US and prefers to buy from the defense suppliers based in these two countries. Dominance of these companies could poses as a barrier for the foreign equipment supplier to enter into the Omani defense market. Lack of skilled labor may also prove to be deterrent for new entrants.

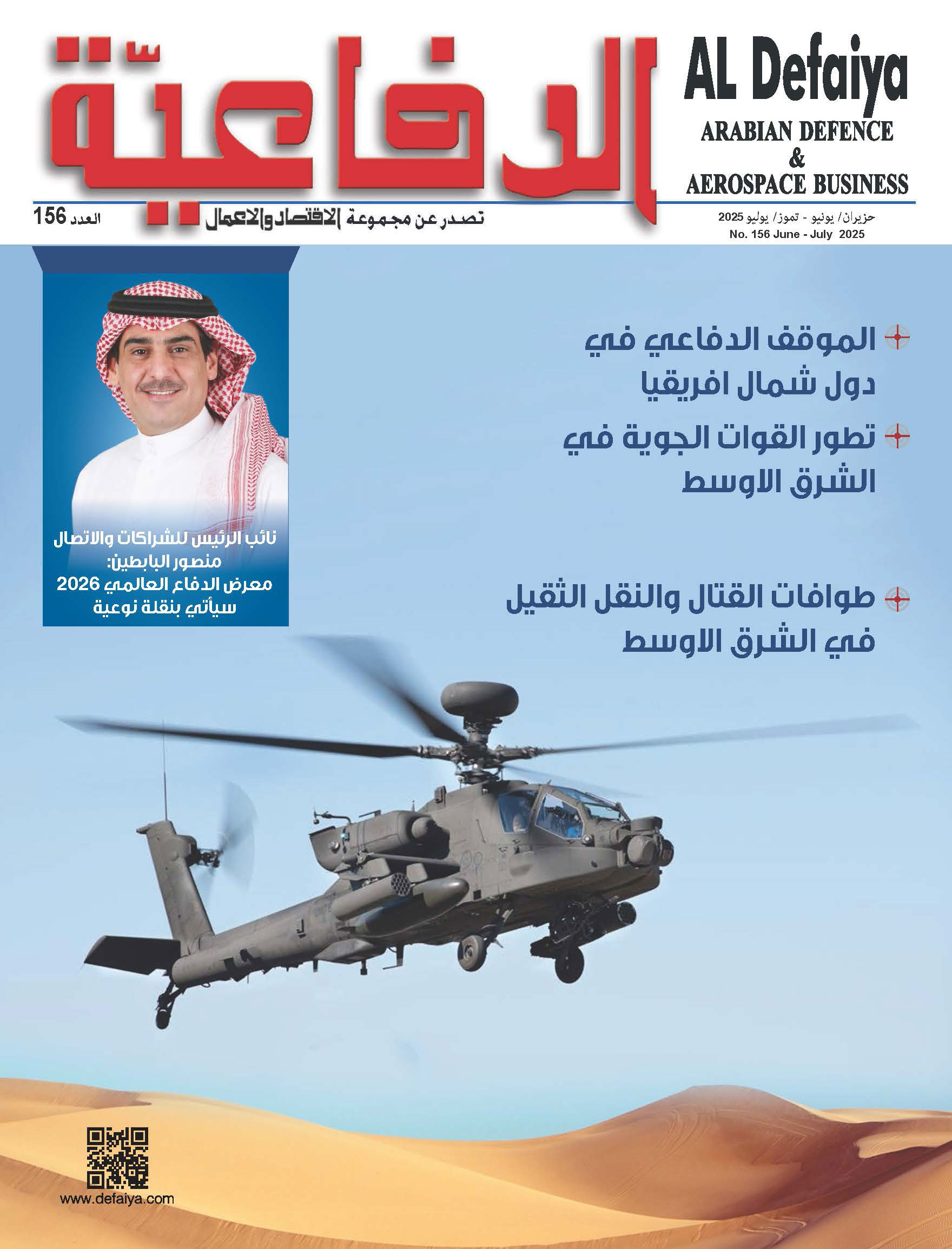

Photo: Oman’s Defense Minister Sayyid Bder Bin Saud Bin Harib Al-Busaidi