Asia’s largest aerospace gathering is usually a “show and tell” event where Executives come to mingle with some of the world’s biggest long-haul carriers and Asia’s ambitious new travel tycoons, as well as the region’s busy military buyers.

After a record $200 billion of deals at last November’s Dubai Airshow, few expect Asian buyers to be ordering in similar quantities - yet the event will test the appetite of one of aviation’s fastest growing regions.

Vietnamese, Indian and Thai carriers will place orders for over 100 Airbus or Boeing airplanes worth $12 billion at list prices, industry officials say. Malaysian Airlines could also place an order for Airbus long-haul and medium-haul jets.

But executives will be looking out for any signs that financial turmoil in key aviation markets like Indonesia and Thailand will threaten economic growth, which directly determines the level of air traffic demand. Boeing does not see its commercial jet business affected by weakness in emerging markets, Chief Executive Jim McNerney said. But he noted more divergence among such countries, and China and the Middle East remained strong.

Airbus and Boeing will face off for the first time with their latest lightweight long-haul jets, the 787 Dreamliner and the Airbus A350. The A350 will make its first full air show appearance.

As well as being a magnet for commercial aviators, the Singapore Airshow is a weapons bazaar which has grown in importance as China’s increased military assertiveness has raised concerns. U.S. arms makers are counting on increased foreign sales to offset slower demand from U.S. and European governments, whose military budgets are under increasing pressure.

While global military spending has been on the decline over the past few years, reflected in the Pentagon’s own budget cuts, Asian spending is on the up.

China looms large in Asia, where it has overlapping territorial claims with several Southeast Asia countries in the South China Sea. At the same, China-Japan tensions have risen over their rival claims to a set of tiny uninhabited islands in the East China Sea.

North Korea’s pursuit of nuclear weapons adds another serious dimension to what is shaping up as an arms race in Asia.

The host country, although one of the smallest in the region, has the deepest pockets and is eyeing new jets. Its immediate priority is a billion dollar upgrade of its F-16s, but is also looking at buying the stealthy F-35, which is built by Lockheed Martin.

Japan has already placed an order for the F-35 - a so-called “fifth-generation” warplane designed to be nearly invisible to enemy radar - and South Korea is expected to finalize an order for the jet this month.

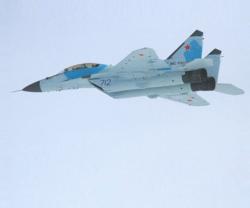

Malaysia is assessing the Boeing F/A-18, Dassault Rafale, Eurofighter Typhoon and Saab Gripen to replace its ageing MiG-29 fighters, while Indonesia is also seen as a potentially big customer for fighter jets.

Singapore and Japan are also eyeing the V-22 Osprey tilt-rotor plans built by Boeing and Bell Helicopter, a unit of Textron Inc. The U.S. Marine Corps is sending two of the planes to the show, which take off and land like helicopters but fly like planes.

U.S. officials are expecting questions and interest in missile defense systems built by Lockheed and Raytheon Co, Boeing's maritime P-8 surveillance plane, and the KC-46A refueling plane, also built by Boeing. South Korea is expected to kick off a tanker competition this spring.