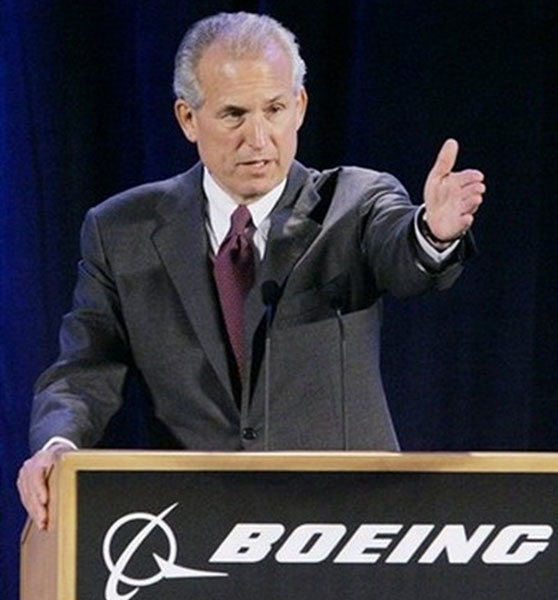

Boeing Chairman, President and Chief Executive Jim McNerney (photo) announced Monday that the Boeing Board of Directors authorized an additional $10 billion for the company's share repurchase plan and declared that the company's regular quarterly dividend will increase by approximately 50% to 73 cents per share.

“These actions reflect sustained, strong operational performance by our businesses, increasing cash flow, and our confidence in the future,” said McNerney.

“Our team's relentless focus on business execution and competitiveness is providing the financial strength to continue investing in our core businesses while increasing our returns to shareholders,” he added.

The $10 billion repurchase authorization approved today is in addition to the approximately $0.8 billion remaining from the 2007 stock repurchase authorization. Repurchase activity for 2013 is complete and is expected to resume in January 2014.

“Our balanced cash deployment strategy provides increased dividends and share repurchase authorization to deliver consistent returns to our shareholders while maintaining investment in productivity and innovation for future growth,” said Boeing Executive Vice President and Chief Financial Officer Greg Smith.

The timing and volume of repurchases are at the discretion of Boeing management, however it is currently expected that the share repurchases will be made over the next two to three years.Repurchases may be made on the open market or in privately negotiated transactions.

The dividend declared today is payable March 7, 2014, to shareholders of record as of February 1.

Boeing is enjoying a surge in revenue and cash as it ramps up commercial jet production, with a target of delivering a record 635 to 645 aircraft this year. Those gains help offset declining US military spending, which is hampering Boeing's defense businesses.

The company is also preparing to invest billions of dollars in two new models, the narrow-body 737 MAX and the wide-body 777X.