A surge in weapons purchases by Saudi Arabia, leading a coalition of nations fighting in Yemen, helped push global arms sales up more than 10% last year, according to HIS Global Defense Trade Report.

The world defense market climbed to $65 billion in 2015, up by $6.6 billion from 2014, said the annual report published Sunday. That’s the largest yearly increase in the past decade, according to the Englewood, Colorado-based consulting firm.

While Saudi purchases jumped about 50% to $9.3 billion, growth was seen across much of the Middle East and Southeast Asia.

As middle-income countries see increases in their gross domestic product, they have more "relative resources" to spend on military equipment, according to Ben Moores, a senior defense analyst at IHS Aerospace, Defense & Security who wrote the report. The study examined trends in the global defense market across 65 countries.

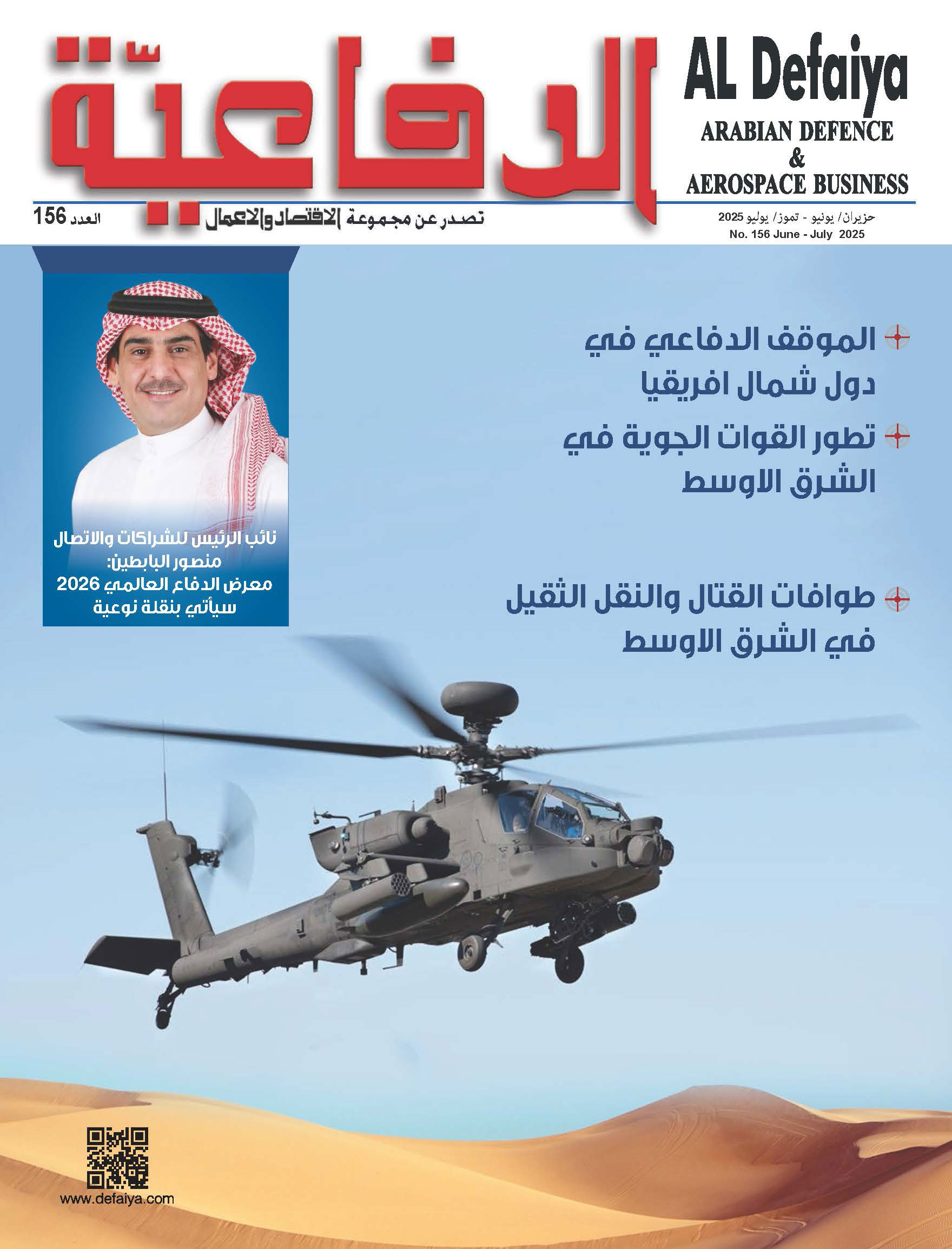

The boost in Saudi weapons imports came as the Kingdom led a coalition targeting Houthi rebels in Yemen and as it works to counter its regional rival Iran. Saudi Arabia’s purchases in the past year include Eurofighter Typhoon jets, F-15 warplanes and Apache helicopters, as well as precision-guided weapons, drones and surveillance equipment, Moores said.

Egypt, whose economy has struggled since the 2011 ouster of former President Hosni Mubarak, became the world’s fourth-biggest weapons importer, spending almost $2.3 billion, according to the report. Before 2013, the country spent $1 billion or less annually, but “there’s been this ramp-up,” Moores said, adding that IHS research indicates the higher spending is being underwritten by Egyptian allies France and Gulf Arab states.

Iraq spent almost as much as Egypt as it shifts money from operations and personnel toward procurement, IHS said. The country is battling Islamic State militants in long-troubled Anbar province and is preparing for the eventual battle to retake the northern city of Mosul.

IHS predicts faltering oil prices won’t recover beyond current levels for another three years, so oil exporters will "have to cut back on procurements,” Moores said. “Countries will spend less on arms and more on operations, as they try to influence events in the region,” he said. Crude has fluctuated at about $50 per barrel in recent weeks, up from $30 to $35 in the first couple months of the year.

Russia, the world’s No 2 exporter behind the US, is likely to increase its trade with Iran as the country begins to replace its aging air force equipment after the nuclear deal reached last year eased international sanctions, the report said. It’s a “massive" undertaking that could cost $40 billion to $60 billion, Moores said.

In Asia, states bordering the South China Sea increased their defense spending by 71% since 2009 as they aim to deter China, with purchases such as aircraft and anti-ship missiles, IHS said.

The US remained the top weapons exporter in 2015, supplying almost $23 billion in goods and equipment, of which $8.8 billion went to the Middle East, boosted by the sale of aircraft and associated mission systems.

“Going forward, the total may exceed $30 billion as deliveries of the F-35 begin to ramp up,” the report said, referring to the next-generation fighter aircraft built by Lockheed Martin Corp.

While Russia has long been the world’s second-biggest arms exporter, France is poised to take that spot by 2018, building on a $39 billion submarine order it won from Australia earlier this year, according to IHS.